Lack of uptake in DC market, prices still high

A new ancillary service procured by National Grid to manage the frequency of Britain’s electricity system remains undersubscribed more than four months after its launch but is showing its potential as a useful new revenue stream for battery projects.

This new service is currently seeing prices significantly higher than those accepted in other frequency response service auctions.

DC was launched on October 1 2020 to support the country’s green energy transition. It is the first of three new frequency response services designed by National Grid to help manage system frequency under conditions of low inertia associated with high amounts of renewable generation, and is expected to provide new market opportunities for battery projects. DC is tendered day-ahead, so provides a flexible revenue stream that units can optimise participation in alongside the wholesale market, but EnAppSys data shows that the average daily volume of bids accepted in DC has remained below targets set by National Grid for the service.

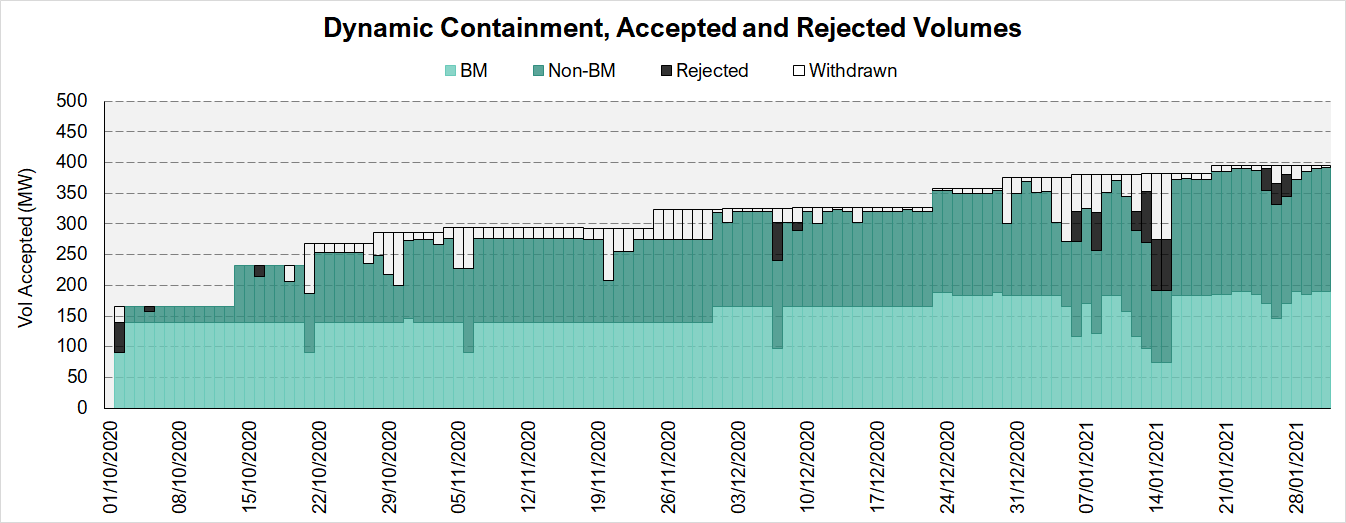

In October, the average daily volume of 197MW was less than half the initial target of 500MW and, while participation has increased steadily, January’s 333MW figure was still less than the 600-800MW target for the month. On average, 92% of tendered volume is accepted, with the rest either rejected for being above the price cap (1% average) or withdrawn, potentially so the unit can participate in other markets (7%). At this low level of uptake, without competition, DC prices have remained at or near £17/MW/h – a premium of around £10/MW/h over the prices achieved over a similar period in other alternative auctions for similar services. These include the weekly and monthly frequency response services (though the costs of service delivery for participants may differ in each case).

The undersubscription may be due to a number of factors, including the technical requirements for DC in terms of performance and metering, which may have deterred some participants. Also, more active market monitoring and tender submissions are needed to participate in a daily auction service such as this compared to monthly or even weekly tendered services. At these levels of participation in the DC market, so far prices have remained near a cap of £17/MW/h, so for participants that have entered, DC is currently providing a useful revenue stream. This price cap relates to the cost to the National Grid of taking alternative actions to reduce Rate-of-Change-of-Frequency (RoCoF) risk in the event of a large generation or demand unit imbalance. Examples of this include bidding off/down large generation units or reducing high levels of interconnector flows if there is insufficient inertia in the system.

There were occasions – notably around the middle of January – when procured DC volumes fell as some units switched to the wholesale market instead to access super-high prices in the day-ahead market and earn higher revenues. This highlights the usefulness of DC as a flexible revenue stream; by operating as a day-ahead auction, it allows participants to take a view of alternative markets and opt in or out of them to maximise revenue. DC participants that operate Balancing Mechanism (BM) units can now also stack their DC activity with bids in the BM following recent changes to the scheme. This allows them to place bids in the BM for the volumes they need to recharge, to replace power they’ve exported in delivering DC, and receive payment for it rather than having to do it at their own expense. In turn, this also gives National Grid greater control over these potential volumes; the Grid can decide when the recharging takes place, allowing it to better manage power flows on Britain’s electricity system. This change to the service may feed into more variability of tendered prices as the ‘price risk’ of re-filling at the bidder’s own cost may be judged to be lower.

We’re currently in the first wave of DC procurement, with the second wave planned for this spring. The second wave is expected to enable more participation resulting from National Grid’s continuing engagement with market parties, so we will be following the service closely to see how it evolves as more units come online.

The daily Dynamic Containment activity – volumes and prices per unit – can be tracked in our market data platform to gain insights into this new market and other segments of the GB and EU electricity markets. If you would like to receive more information, please contact us.

A new ancillary service procured by National Grid to manage the frequency of Britain’s electricity system is set to support the country’s green energy transition and provide new opportunities for battery projects.

This new service, Dynamic Containment, is one of three new frequency response services designed by National Grid to help manage system frequency under the conditions of low inertia associated with high amounts of renewable generation. New forms of frequency management are needed because, with renewables now providing a significant share of power generation in Britain (35% of power in 2019), the market is running on its lowest ever share of power from conventional sources.

This increase in renewable generation sources has been developing through the past decade but, unlike renewables, conventional power sources, in addition to their active power provision, also have a value for National Grid as a source of inertia resulting from the stored kinetic energy in the spinning mass of the turbines and generators.

In the event of any unexpected loss of generation on the network, the generation of power becomes less than the electrical demand of the system, which will cause the rotational speed – and hence the system frequency – to drop. Inertia from conventional generation provides some mitigation to slow the rate at which frequency would drop.

With fewer conventional turbines spinning, there is less resistance to changes in frequency because for renewables in the market, there is either no mechanical generator of power, in the case of solar projects, or there is a decoupling between the mechanical and electrical system, as in the case of most wind farms. As a result, the conventional coal, gas and nuclear plants are currently required to provide this inertia.

As operator of the network, National Grid has led the Future of Balancing Services programme to develop the tools and products needed to meet the challenges of these changes to the system fuel mix.

As part of this programme, the three new frequency response products are being created, with the first of these, Dynamic Containment, launched in October 2020. It effectively adds a set of – for now – battery projects that are ready to increase generation in response to any frequency drop to rapidly replace any lost generation. Other technologies may also emerge to provide this service as they evolve over time.

Whilst batteries are non-synchronous generators and cannot provide (real) inertia to slow a frequency change, they can still support system frequency as it is a balance of generation and demand. As they can generate or absorb power quickly, batteries can rapidly step in to help manage this balance when frequency deviates from the target of 50Hz.

This service is faster than the previous iterations of similar services that it is now operating alongside. This decreases the total loss of rotational speed – or loss of frequency – that occurs when a generation loss against demand occurs, because the loss is sustained for a shorter period of time.

Dynamic Containment is also the first service of its kind in GB to be procured via daily auctions, providing an alternative route to market for battery projects that have been unsuccessful in providing frequency response services to the grid in the preceding monthly tenders and weekly auctions. If a unit is not accepted into any of these frequency response services, they are still able to help the system in other ways by running as required in the normal power markets.

The daily Dynamic Containment activity – volumes and prices per unit – can be tracked by companies such as EnAppSys, for insights into this new market. As this is a relatively exclusive service – full delivery must be within 1 second, but no faster than 0.5 seconds – the price of this new service remains high at £17/MW/h, which represents a premium of ~£10/MW/h over the prices achieved over a similar period in other alternative auctions, though the costs of service delivery may differ.

But although the price is high, the value to the system of delivering this very fast volume is likely to offset any associated costs and daily procurement means that as competition in these markets grow, the price is likely to decrease overall. As more volumes are procured to increase the amount of response delivered, prices should start to reflect the wider market more closely and this could see more peaks and troughs of value that should help to ensure a cost-effective solution. To date, volumes of ~250MW have been procured against a target of 500MW. Whilst the target is yet to be met, competition is low, meaning that the price premium for Dynamic Containment remains notable. Once the full 1GW of Dynamic Containment intended to be procured by National Grid is online, we expect to see its effects on the amount of inertia National Grid needs to hold on the system, along with effects on balancing to reduce largest points of loss.

As the first of these new ancillary (grid stability) services launched by National Grid to create a framework of services that meets the challenges of integrating a higher percentage of renewables on the grid, it begins a new era for how power networks are managed.

In these interesting times, the auction appears to have been successful in delivering a service at commercial prices that will attract entrants to participate in it. Over time, we need to see how it evolves because currently only a limited amount of volume is being procured through this service, but the indications are promising for the future.

Dynamic Containment also illustrates the potential for revenue to be gained by being flexible and actively monitoring these markets for potential opportunities. Although active monitoring may be more labour-intensive than the work needed to secure a full month’s activity in a single tender, the value for generators as they support the needs of the system is likely to make that work worthwhile, further evolving the way the market operates and reacts around changing renewable positions. Over time, the market is expected to migrate from the current framework of monthly and weekly auctions to daily and, eventually, four-hourly auctions, further highlighting the value of flexibility for revenue potential.

Click here to download the full paper